Calculate my weekly paycheck

Ad Users Who Switch To Our Software Report More Accurate Time Tracking. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

How To Calculate Monthly Income From Biweekly Paycheck Hassle Free Savings

Your employer withholds a 62 Social Security tax and a.

. Calculate your paycheck in 5 steps. The calculator is updated with the tax rates of all Canadian provinces and territories. Free salary hourly and more paycheck calculators.

See Offer Details Now. Our online Weekly tax calculator will automatically work out all your deductions based. Get a free quote today.

Use this calculator to see how inflation will change your pay in real terms. Ad Paycheck Method - Weekly Paycheck Method. This includes just two items.

Ad Create professional looking paystubs. Next divide this number from the annual salary. This number is the gross pay per pay period.

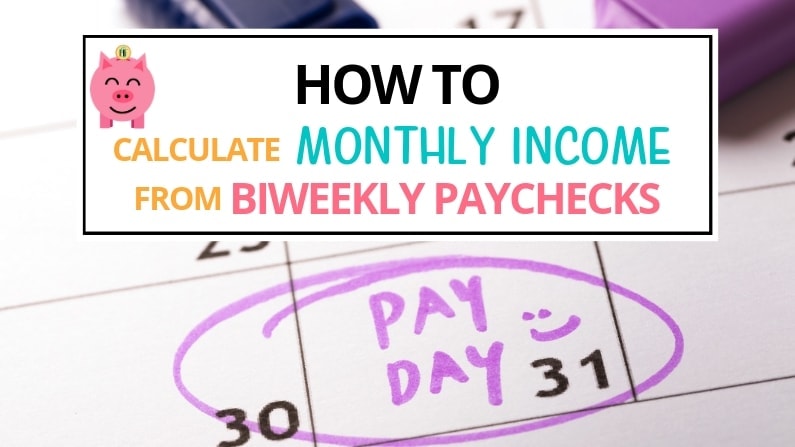

Ad Payroll So Easy You Can Set It Up Run It Yourself. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. 1500 per hour x 40 600 x 52 31200 a year.

All inclusive payroll processing services for small businesses. Due to the nature of hourly wages the amount paid is variable. For the cashier in our example at the hourly wage.

This will help the tool calculate some of the employees local taxes. There are five main steps to work out your income tax federal state liability or refunds. Simplify Your Day-to-Day With The Best Payroll Services.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Free Unbiased Reviews Top Picks. Ad Compare and Find the Best Paycheck Software in the Industry.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Need help calculating paychecks. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Input the date of you last pay rise when your current pay was set and find out where your current salary has. We use the most recent and accurate information. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

Get your Free Copy here. Your weekly benefit amount and the number of weeks of entitlement are based on the wages you were paid and the amount of time you worked during your base period. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Ad Compare This Years Top 5 Free Payroll Software. Subtract any deductions and.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Ad Accurate Payroll With Personalized Customer Service. Get 50 Off For 4 Months.

Sign Up Today And Join The Team. Yearly Semi-annually Quarterly Monthly Bimonthly Biweekly Weekly Daily. Divide your weekly income by how many hours you typically work in a week.

Calculating paychecks and need some help. Sign Up Today And Join The Team. Enter your pay rate.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. But calculating your weekly take-home. The amount can be hourly daily weekly monthly or even annual.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your. So if you make. Learn About Payroll Tax Systems.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Salary Paycheck and Payroll Calculator. For example if you work 8 hours a day 5 days a week that is 40 hours per week.

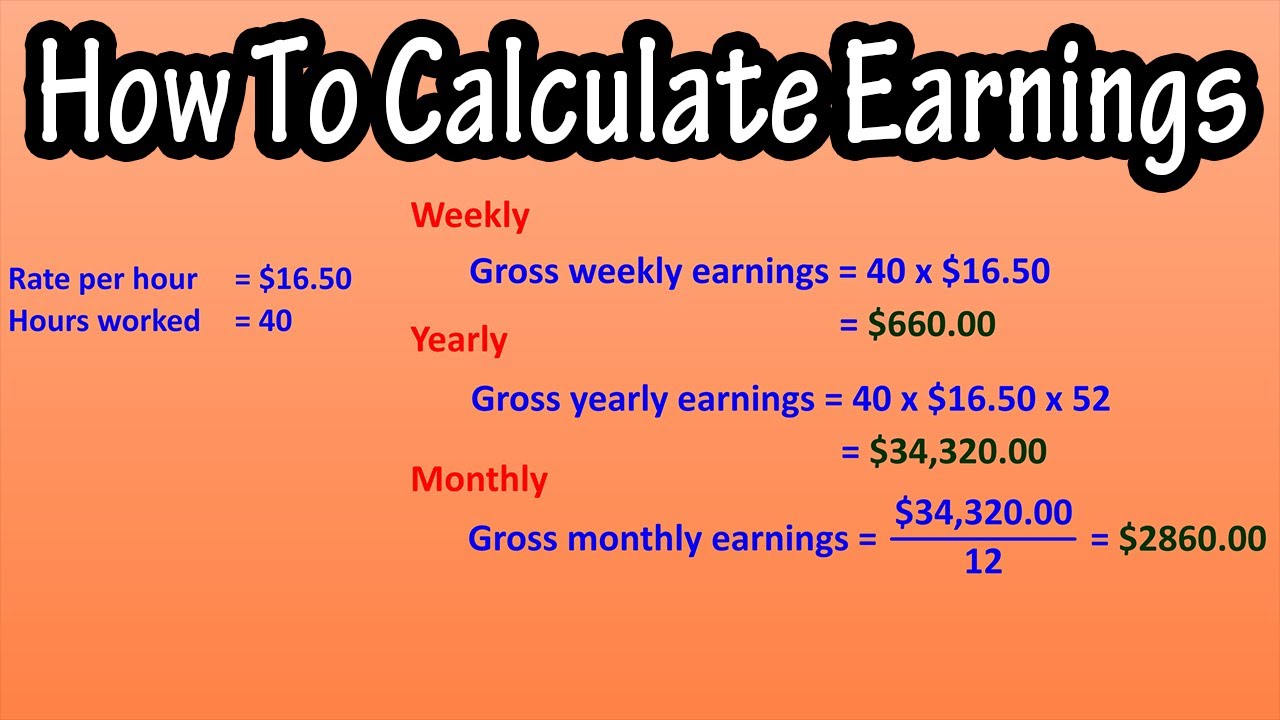

A Hourly wage GP WPD B Daily wage GP C Weekly wage GP. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. Fill in the employees details.

C Weekly wage GP WPD WDW D Monthly wage E 12 E Annual wage 52 C - In case the pay rate is daily. How Your Paycheck Works. It can also be used to help fill steps 3 and 4 of a W-4 form.

Learn About Payroll Tax Systems. If your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate what your weekly paycheck will be. Hourly Paycheck and Payroll Calculator.

First you need to determine your filing status to. How to calculate your paycheck. Get a free quote today.

Their name and the state where they live. Over 900000 Businesses Utilize Our Fast Easy Payroll. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

All Services Backed by Tax Guarantee. Discover how my Weekly Paycheck Method tripled account in 8 mo. Generate your paystubs online in a few steps and have them emailed to you right away.

Weekly pay 48 weeks.

Paycheck Calculator Take Home Pay Calculator

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

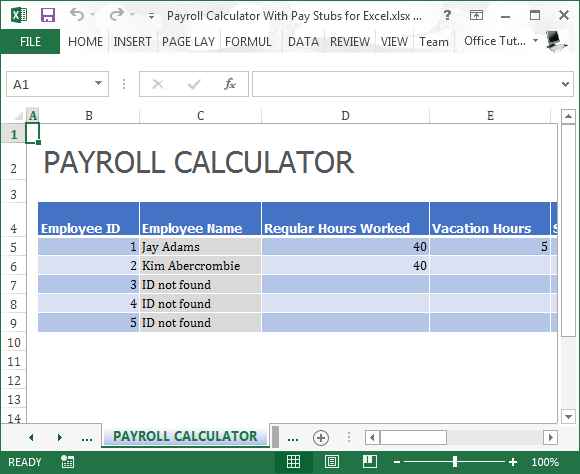

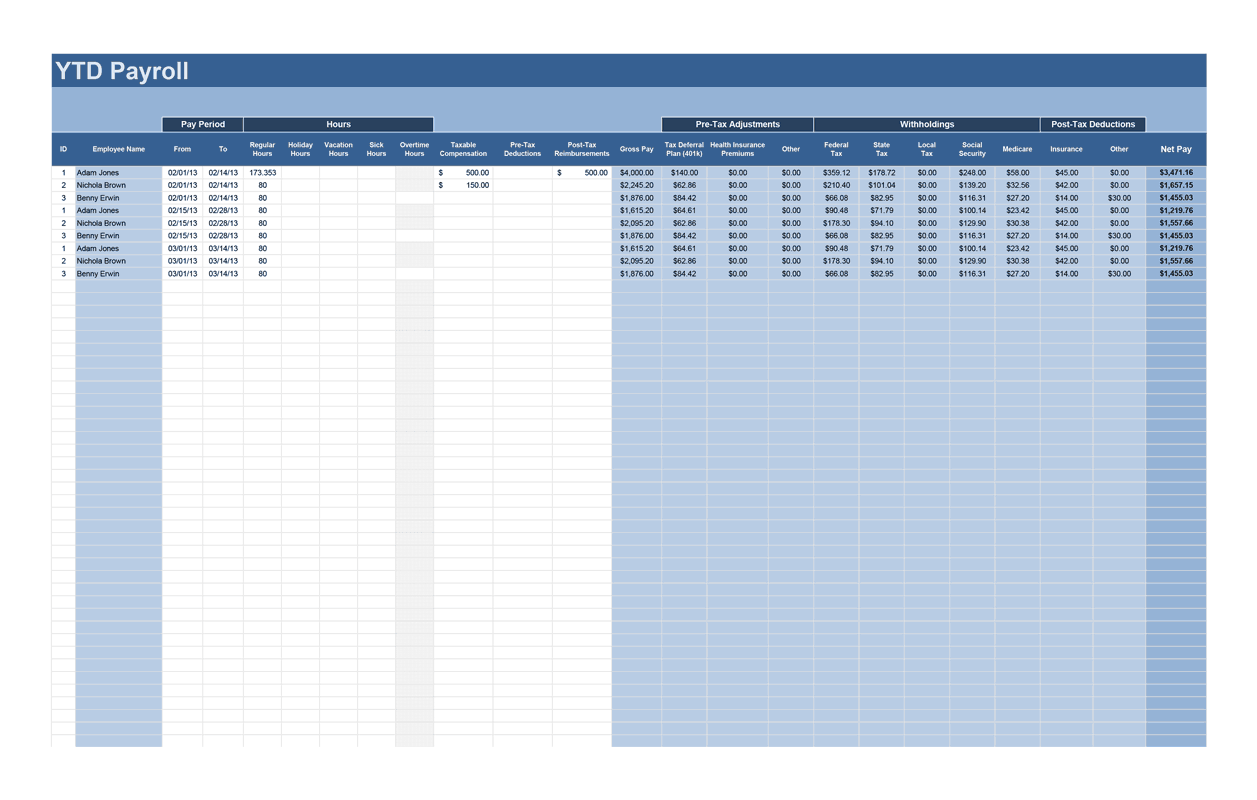

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Monthly Income From Biweekly Paycheck Hassle Free Savings

Paycheck Calculator Online For Per Pay Period Create W 4

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Calculate A Paycheck For Your Employees Youtube

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator With Pay Stubs For Excel

How To Calculate Federal Withholding Tax Youtube

Federal Income Tax Fit Payroll Tax Calculation Youtube

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

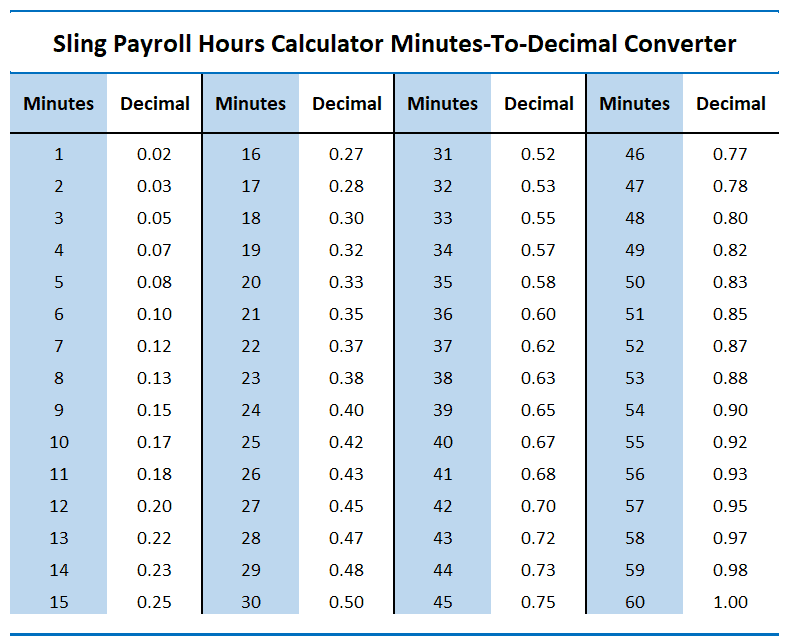

How To Calculate Payroll For Hourly Employees Sling

Payroll Calculator Free Employee Payroll Template For Excel

Free Online Paycheck Calculator Calculate Take Home Pay 2022